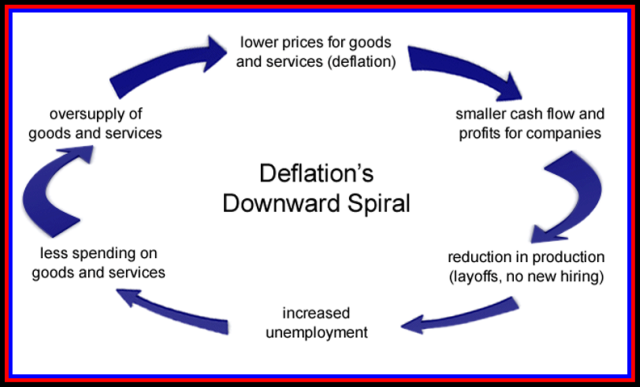

January 19, 2013 – Japan‘s Volley in Currency wars a Real Worry: Forget the fiscal cliff. Competitive devaluations pose an even bigger threat to the global economy. Start anywhere on the Deflationary Spiral Graphic – can you feel the tree branches hitting you in the face as the global economy hurdles toward calamity?

The most important recent global macroeconomic development has nothing to do with the fiscal cliff or the debt ceiling in the U.S. Arguably, it is the sharp shift since last year in Japan to pursue policies that explicitly and aggressively aim at producing inflation.

After two so-called lost decades of deflation, Japan’s Liberal Democratic Party led by Shinzo Abe was swept back into power on a program of fiscal and monetary stimulus, in particular to lower the value of the yen to restore the international competitiveness of the nation’s export-dependent industries.

Japan’s famously huge trade surplus has shifted to a deficit, which in part is a result of the devastating earthquake and tsunami, which forced a sharp rise in energy imports.

Since then, most major central banks have sought to curtail the appreciation of their currencies to maintain export competitiveness. That has even extended to the Swiss National Bank, which has pledged to cap the Swiss franc‘s exchange rate against the euro to €1.2. That’s meant printing Swiss francs by the carload to prevent the demand from wealthy European seeking to protect their wealth from a possible collapse or unraveling of the euro from making export-dependent Swiss companies completely uncompetitive in world markets.

Until now, the BOJ has been a holdout in joining in the currency wars. The Fed, despite being the overseer of the world’s reserve currency, takes little regard of the dollar’s exchange rate. The European Central Bank has seen the euro’s strength as a vote of confidence in its policies. But with the euro having jumped 14% against the yen since late October, the ECB may be pressured to change its tune. That price swing may induce some buyers to switch to a Lexus from a Mercedes or to a Toyota from a Volkswagen, for instance.

If so, it threatens a beggar-thy-neighbor competitive devaluation spree that would recall the 1930s, in which currencies were employed as a weapon of protectionism. That was an important factor in making the Great Depression a global affair. Follow the link below for the complete story. (Credits – Randall W. Forysth for Barron’s Magazine).

The Master of Disaster

Japan’s Push for Lower Yen Poses Risk to Economy, Markets – Barrons.com#articleTabs_article%3D1.

Reblogged this on Living in Phnom Penh.